In the previous post we provided a broad definition of the foreign exchange market; it is know the time to provide an explanation about its operating principle.

How the Forex market works

The FX market does not have a trading floor, nor are trades executed in an exchange (such as the London Stock Exchange), rather it takes place in an Over the counter (OTC) market, also known as quote-driven dealer market. In this type of market, several dealers (or broker-dealers) participate in every trade and supply all the liquidity. Anyone who want to trade currencies must trade at the dealer’s quoted prices at which he will buy and sell.

Multi-tier market

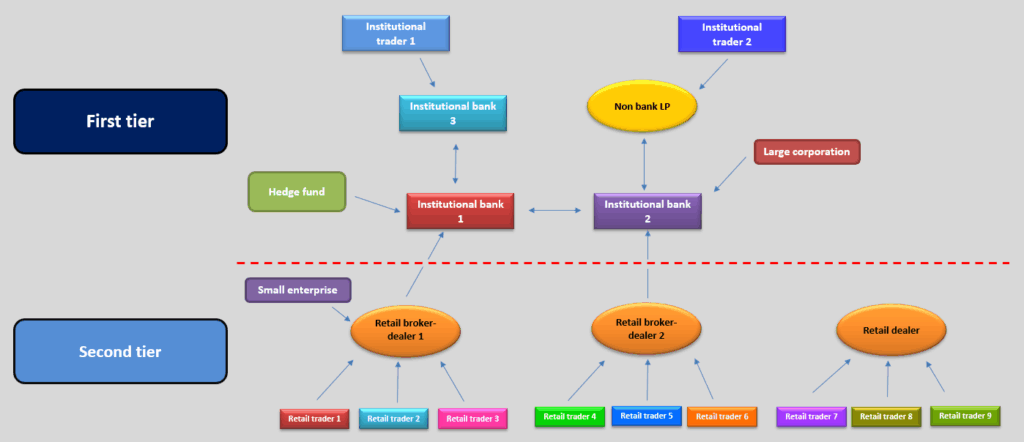

It is best to imagine the Forex market as having a two-tiered structure: the top tier is known as the Interbank market or Interdealer market and is mainly made by big institutional banks (also known as Tier 1 banks or liquidity providers or institutional dealers) such as Deutsche Bank, UBS, Barclays, Morgan Stanley, Goldman Sachs and non-banks liquidity providers such as Citadel Securities, Flow Traders, Virtu Financial. The Interbank market accounts for a very large percentage of total currency volume trades and represents the backbone of the FX market.

The size of a single transaction is usually in the order of millions of dollars and Interbank deals may take place on behalf of the banks’ own accounts (proprietary trading) or on behalf of their customers which usually are institutional traders, hedge funds and big corporations. The large commercial banks and non-banks liquidity providers operating in this tier are the primary market makers for the foreign exchange market and the competition among them ensures tight spreads and fair pricing.

While Tier 1 banks still negotiate deals with each other or with their clients verbally via telephones and call boxes, recent technologically advances have made electronic trading increasingly popular in the Interbank market and they now trade mostly through proprietary trading platforms.

Not all Tier 1 banks trade with each other or with any client, the Forex market is indeed a credit-approved system where market participants trade based solely on the credit relationships they have established with one another. Those who do not have direct credit relationships with dealers, trade through brokers who guarantee that they will settle their trades. The best prices and higher liquidity are naturally extended to those participants with higher credit access.

Forex market structure

The second tier is mainly made by retail dealers or broker-dealers. Even if at this level the total volume traded is far lower than in the Interbank market, it is nonetheless a growing sector that ultimately adds a layer of liquidity to the overall FX market. Retail broker-dealers allow currency trading to those participants who do not have enough trustworthiness and creditworthiness to get access to the interbank market such as retail traders and small companies.

The larger the retail broker-dealer is in terms of capital available, the greater the access will have to a high number of liquidity providers and the more favourable the pricing and trade volume it will receive from the Interbank market thereby improving the overall trading conditions for its clients.

Leave a Reply